The hospital-at-home concept isn’t new, but the COVID-19 pandemic has accelerated its usage.

By Jane Sarasohn-Kahn, MA, MHSA

Note from the editor: This post was originally published in August 2020 and was last updated in February 2021.

In 2020, the coronavirus pandemic adversely impacted inpatient hospital capacity in geographies where COVID-19 has spiked, from New York City in the first weeks of the crisis to major cities in Arizona, Florida and Texas.

The pandemic accelerated the adoption of telehealth, which enabled another trend that the crisis fostered: the concept of hospital-at-home.

Hospital-at-home (HaH) is not a new thing: The concept has been used to manage patients with chronic conditions like heart failure who can be managed at home, preventing readmissions and enhancing a patient’s quality of life. It also has proved effective in managing healthcare costs through caring for a patient in a lower-cost setting: her home.

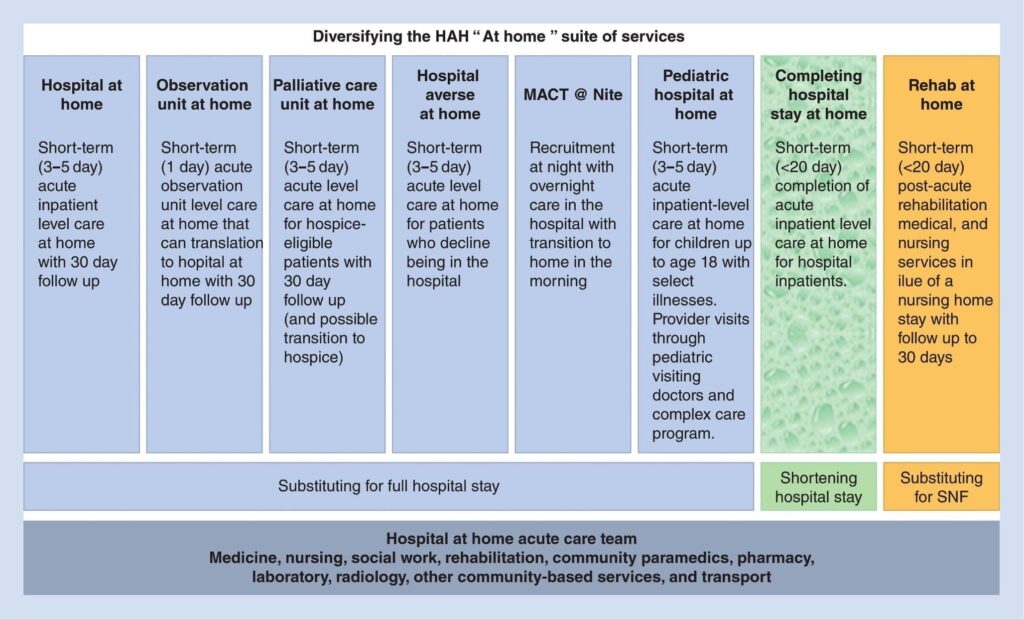

Hospital-at-home services combine home visits with virtual care and remote monitoring. Think of this as advanced home care, or acute care delivered in a patient’s home via virtual health technologies and wrap-around home care services. As the concept is emerging, there are many flavors of HaH, shown in the table as a suite of services.

Image Credit: Acute Care in the Home Setting: Hospital at Home (Copyright Springer Nature Switzerland AG 2020).

Virtual Care as a Building Block: The New Patient Expectation

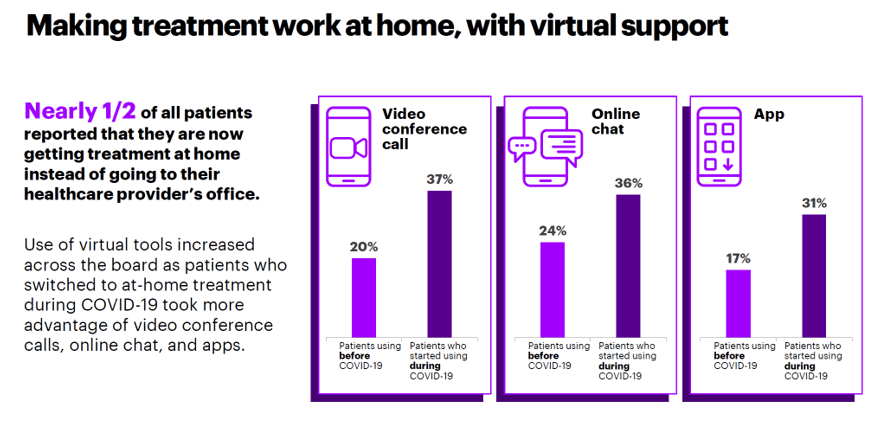

COVID-19 has permanently altered patient behavior, Accenture learned in a global consumer survey conducted in May 2020. Within the first months of the pandemic, millions of patients received medical treatment at home, avoiding visits to healthcare provider offices and hospital clinics. Health consumers receiving care at home tried out a range of devices and platforms, from remote monitoring technologies to videoconference calls with doctors and nurses.

Image Credit: Accenture

Two-thirds of patients who used virtual care services during the pandemic reported a key benefit from doing so: They did not have to worry about being exposed to other potentially sick patients, an Updox poll found.

By summer 2020, the “curve” of coronavirus cases in the U.S. had not sloped downward the way the numbers did in other parts of the world. Early in the pandemic, some had hypothesized that the warmer summer climate might flatten the curve of cases.

Instead, with the continuing rise of cases and deaths due to the coronavirus, U.S. health consumers’ “fear of going out” ticked up in June, with concerns about leaving home risking exposure to COVID-19 continuing into the middle of July. In the first week of July, at least 90 million Americans had delayed medical care in the previous four weeks, the U.S. Census Bureau learned.

On the patients’ demand side, the stage was thus set for people to accept and welcome healthcare delivered to their homes.

Telehealth to the Home Enabled Through Internet of Medical Things

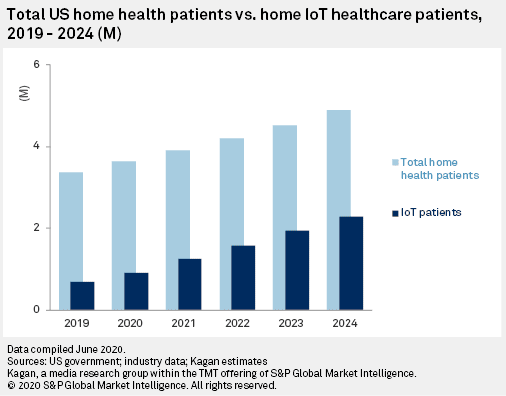

On the supply side of telehealth, the COVID-19 pandemic inspired a “U.S. telemedicine boom,” Standard & Poor’s Kagan research unit forecasted. In particular, S&P’s expectation is that healthcare will shift from outside to inside the home, and especially for people 65 and over: namely, patients enrolled in Medicare programs.

The S&P forecast combines telemedicine and cloud-connected, Internet-of-Things (IoT) medical devices—the technologies that underpin hospital-at-home. IoT medical devices transmit healthcare signals to the cloud, enabling providers to monitor patients outside of the inpatient setting. There is a growing portfolio of medical-grade devices that can be used to monitor patients at home, including technology that monitors vital signs, pulse oximeters, glucose monitors and oxygen equipment, among other technologies.

S&P notes the Internet of Medical Things at home will be bolstered by two key trends: Medicare and the FDA “leveling the field” between the home and the doctor’s office for telehealth payment parity in the COVID-19 pandemic; and the falling costs for clinical devices that consumers can use in the home setting.

S&P forecasts that the Medicare and FDA approaches will persist beyond the pandemic.

Hospital-at-Home Pioneers in the U.S.

The concept of hospital-at-home (HaH) is more mature in some countries outside of the U.S. This is largely due to payment regimes: In the U.S., hospitals’ revenue is based on volume and filling beds. In nations where hospital-at-home has been successfully deployed, such as Australia, England, Italy and Spain, healthcare financing is rooted in budgets.

One of the first health systems deploying hospital-at-home was Johns Hopkins University, which also consults with providers looking to launch a program. Hopkins says its program derives greater patient satisfaction; achieves cost savings of 19% to 30% compared with traditional inpatient care; lowers average length of stay and generates fewer lab and diagnostic tests; drives greater patient satisfaction; and results in lower mortality rates.

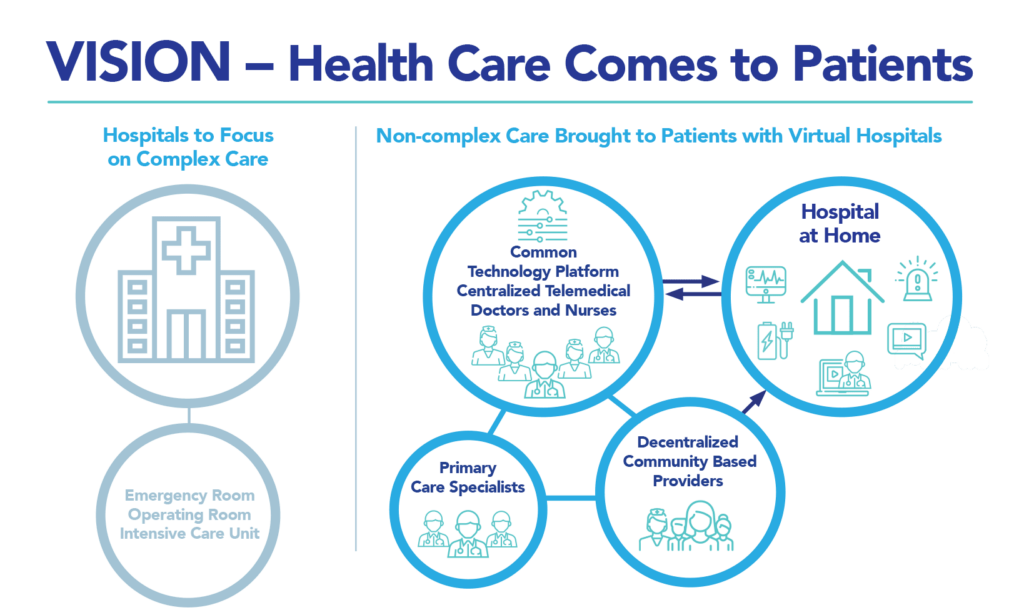

The Mayo Clinic began partnering with Medically Home, a company that has a program called the Virtual Hospital, which sets up patients’ homes with advanced medical care at the bedside. A key motivation for Mayo in adopting HaH has been to conserve inpatient and intensive care capacity at the medical center in response to the COVID-19 pandemic. The Mayo Clinic piloted the program in Eau Claire, Wisconsin, and Jacksonville, Florida (a major pandemic hot spot) in summer 2020. This vision drawing presents Medically Home’s hospital-at-home concept.

Image Credit: Medically Home

Northwell Health, in New York City, also implemented hospital-at-home during the coronavirus pandemic to conserve inpatient bed capacity. Its approach has focused on COVID-19-positive patients in the community outside of the hospital who fell in the mild-to-moderate range of severity. The program leveraged telehealth and, when required, set up advanced home care “wrap-around” services that created a hospital-at-home setup for monitoring and medical care. Dr. Thomas McGinn of Northwell, who helped organize the HaH program, was quoted in The New York Times: “80 to 90 percent of the patients who had the virus never went to the hospital. Hospitals were becoming this place that scared everybody.”

Minnesota provider North Memorial Health collaborated with a home care provider, Lifesprk, to organize a Hospital@Home program in the pandemic. Their goal has been to make the hospital “COVID-19-surge averse while helping it get lower-acuity patients out of the hospital sooner.” Their focus has been on seniors, as they describe on the hospital’s website: They provide patients with 24/7 support from a dedicated nursing and physician-led team coupled with Lifesprk’s “telepak in-home monitoring kit.” That technology bundles various remote health monitoring devices such as pulse oximetry, blood pressure, scale and video-call capabilities.

The Future of Hospital-at-Home

North Memorial Health’s medical director for clinical quality, Dr. Jeff Vespa, noted that, “With COVID-19 necessitating consideration of how we can more efficiently and effectively care for people, we see payment mechanisms advancing to support more innovative modes of care delivery. We are able to fund this work through both traditional fee-for-service and newer value-based contracting options allowing us to serve a broad customer need.”

Payment will be the key barrier to hospital-at-home adoption. In the pandemic era, Medicare and commercial payers have provided payment parity and waivers for reimbursing virtual care during the crisis.

Dr. John Halamka, president of Mayo Clinic Platform, believes that “care at a distance,” fast-adopted in the pandemic, will not be rolled back. “There’s a consensus across government, academia and the industry that this is where it is going to stay,” Dr. Halamka said.

Furthermore, as payment for healthcare in the U.S. continues to migrate toward value-based paradigms, there is a hard-dollar incentive baked in to adopt care sited in lower-cost settings.

Another migratory path has also become clear: that millions of patients in the U.S. remain concerned about exposure to COVID-19, preventing them from seeking care and managing health concerns.

Ultimately, the home is morphing into a locus of medical care beyond wellness, fitness and over-the-counter medicine consumption. The growing list of health systems adopting hospital-at-home programs is arming people’s houses with medical devices that collect patient-generated data and keep it flowing to healthcare clouds into the diagnostic and caring embrace of clinicians.

For several years, Philips Healthcare, a digital health company, has had a vision of this new definition of “medical home.” The organization has been intensively involved in the pandemic, fast-pivoting to COVID-collaborating with hospital clients around the world. Two key players in this effort recently discussed the company’s efforts in a LinkedIn Live session.

Their concept of the “Three H’s” spoke to the growing role of patients’ residences as locations for medical care. Those “h’s” are the hospital, health hubs in the community, and the home.

Jeroen Tas, chief innovation and strategy officer at Philips, further described the company’s vision for networked care, asserting that, “Regular care has to be outside of the hospital … that is, for critical care in an environment that has risk. Patients should increasingly be monitored and guided at home, communicating from home to hospital.”

This has been a key learning for all of us touched by the pandemic. Our fear of going out, coupled with the need for hospitals to manage scarce inpatient capacity while conserving costs, makes the hospital-at-home concept such a compelling new normal for healthcare.

About The Author: Jane Sarasohn-Kahn, MA, MHSA

Through the lens of a health economist, Jane defines health broadly, working with organizations at the intersection of consumers, technology, health and healthcare. For over two decades, Jane has advised every industry that touches health including providers, payers, technology, pharmaceutical and life science, consumer goods, food, foundations and public sector.

More posts by Jane Sarasohn-Kahn, MA, MHSA