Health economist and trend weaver Jane Sarasohn-Kahn shares insights on how COVID-19 (coronavirus) is impacting Americans’ behavior and spending – and the implications for health systems and plans.

By Jane Sarasohn-Kahn, MA, MHSA

The coronavirus, aka COVID-19, is re-shaping human lives around the world. From China to Italy, South Korea to the south side of Chicago, people are facing daily challenges in their personal, work, financial, and community life-flows.

For people who live in the U.S., the WHO-declared pandemic challenge is complicated by the fragmented way health care is financed, accessed and delivered. In no other nation in world do employers play a major role in sponsoring health insurance, which in the U.S. covers about one-half of people covered by a health plan.

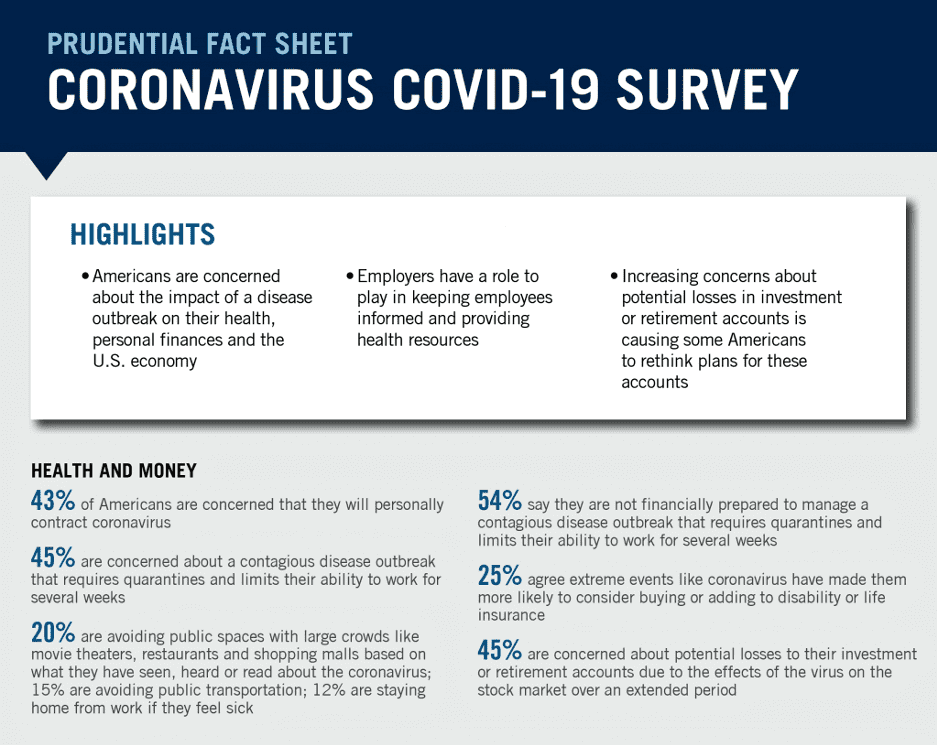

Last week’s stock market dive leading to this week’s Black Monday raises the specter of macroeconomic decline for the nation, and even more challenged personal household kitchen table economies. Prudential surveyed U.S. consumers in late February 2020 on Americans’ perspectives of the Coronavirus. For context, this poll was conducted before WHO declared the COVID-19 a pandemic and Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, testified to the House Committee on Oversight and Reform and asserted on March 11, 2020, that, “Bottom line, it’s going to get worse.”

First, foremost, Americans are concerned about the impact of a disease outbreak on their health, personal finances and the U.S. economy:

- 54% of people are not financially prepared to manage a contagious disease outbreak that requires quarantines and limits their ability to work for several weeks

- 43% of Americans are concerned they will contract coronavirus

- 45% are concerned about a contagious disease outbreak that requires quarantines, limiting their ability to work for several weeks.

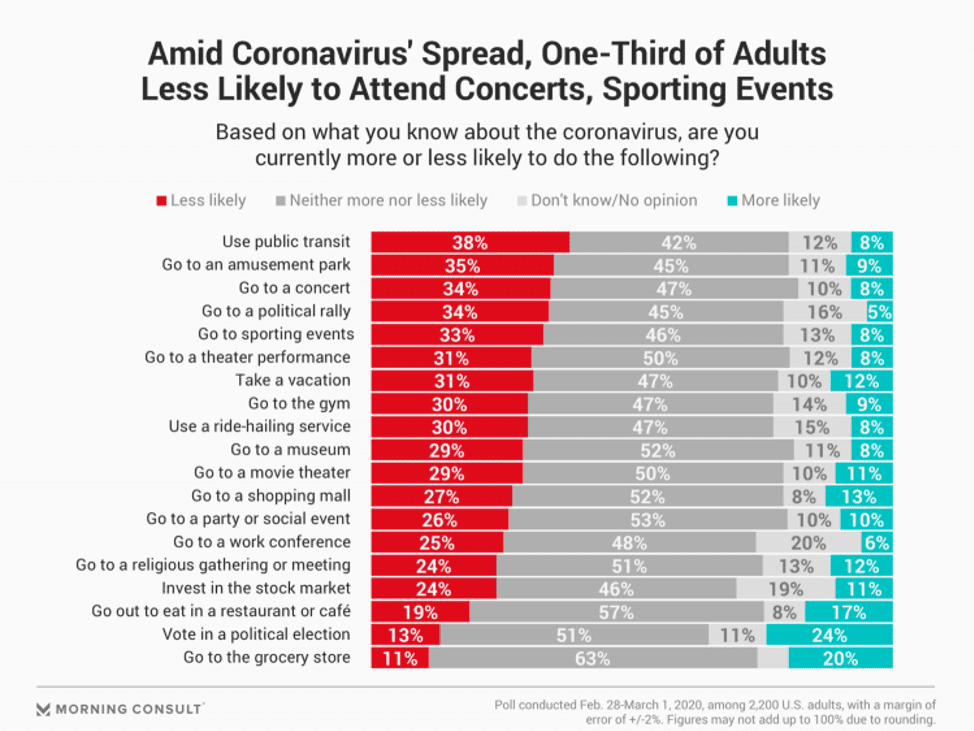

Based on their concerns about exposure to coronavirus, Americans were already adapting their daily behavior in late February and early March 2020, a Morning Consult poll found.

About four in ten people were less likely to use public transit; one-third less likely to go to an amusement park, a concert, a political rally or a sporting event; and 3 in ten Americans less likely to take a vacation, take in a theatre performance, go to the gym, use Uber or Lyft, or go to the cinema to see a movie.

At the same time, note the consumer products that are, in the words of Ad Age magazine, “emerging healthier from the coronavirus:” Clorox, Lysol and Purell addressing hygiene; 3M which supplies med/surg supplies; Campbell Soup Co. with that “comfort food” ethos; Netflix, channeling that movie theatre experience to the home; and, Zoom, buoyed by companies’ mandating that employees work at-home and avoid coming to offices as part of so-called “social distancing” strategies to stem viral contagion. The stock prices of the twelve brands that Ad Age highlighted bucked the trend on “Black Monday”, March 9th 2020, with rising stock prices and growing sales.

For example: the embattled brand Peloton, which lost some brand equity in the preceding weeks due to the “Peloton Wife” commercial, saw its stock up 14% in late February. The Morning Consult poll, described above, found that 30% of Americans were less likely to want to hit the gym. That trend benefited Peloton.

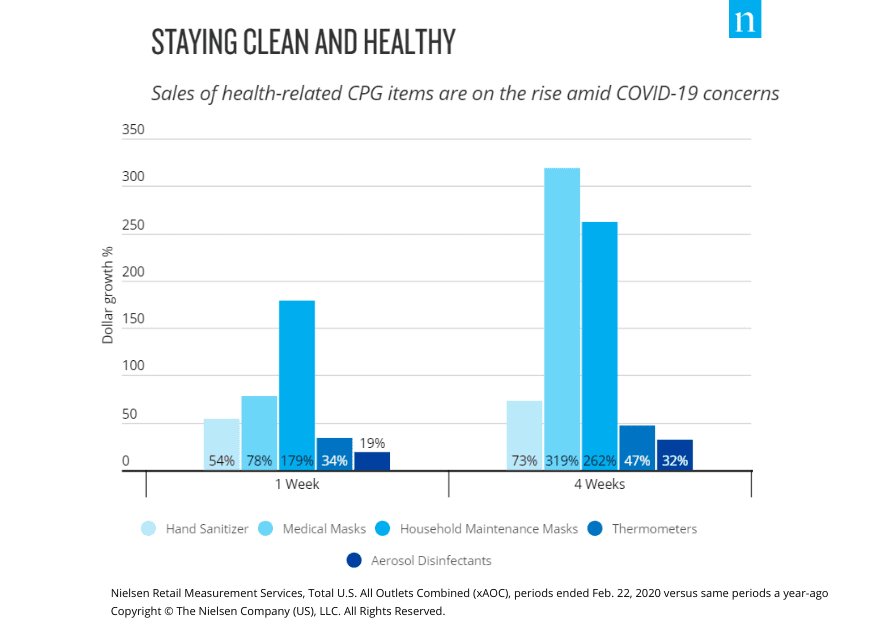

Nielsen has been analyzing the impact of COVID-19 in the past few weeks, first in a report on so-called “Pandemic Pantries” pressuring the supply chain amid coronavirus fears. “Consumers around the world are actively stockpiling emergency supplies as concerns grow that…COVID-19 could become a worldwide pandemic,” Nielsen observed in the early phase of this research.

Nielsen is tracking five aspects for COVID-19 consumer impacts:

- The impact of the virus’s spread on consumer goods manufacturers and retailers

- Staying healthy strategies among consumers, like buying out the shelves of Purell hand sanitizers and purchasing vitamins, minerals and supplements for immune support

- Preparing the “pandemic pantry” for shelf-stable essential foods

- Passing on produce, a trend toward shelf-stable and frozen options (e.g., frozen spinach vs. fresh, pasta-and-grain-based meals vs. raw fresh protein)

- Thinking beyond the bug at other categories of consumer purchases.

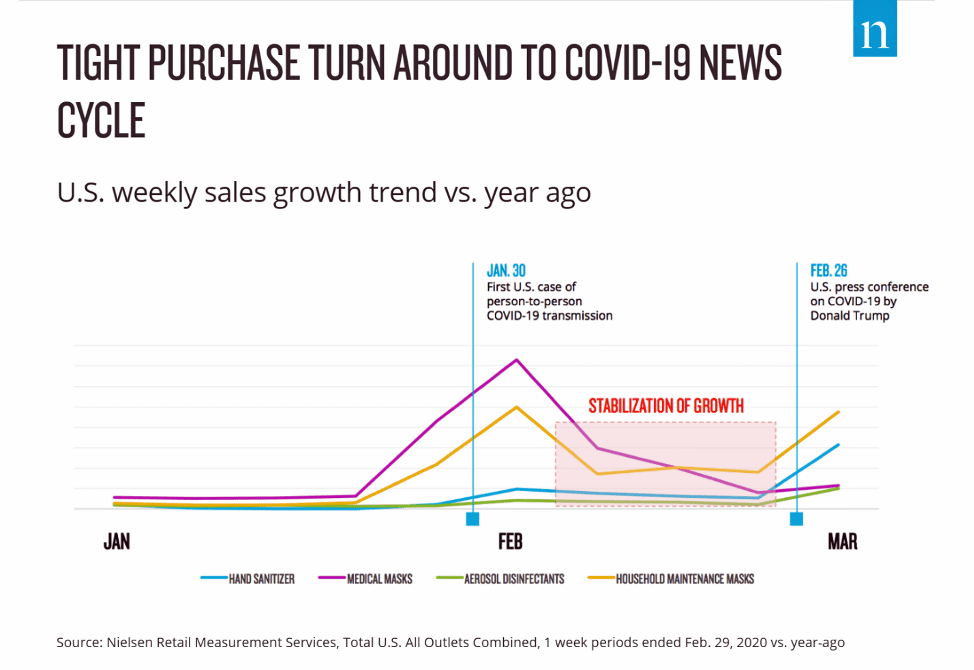

Here’s Nielsen’s view on four categories of Americans’ consumer spending between the beginning of 2020 into the first week of March. Once the first U.S. case of person-to-person COVID-19 transmission was announced on January 30, note the quick update in early February of medical and household maintenance masks. Early March saw the fast growth of hand sanitizer sales, which by the second week of March was garnering price-gouging from certain sellers on Amazon and in brick-and-mortar retail, as well.

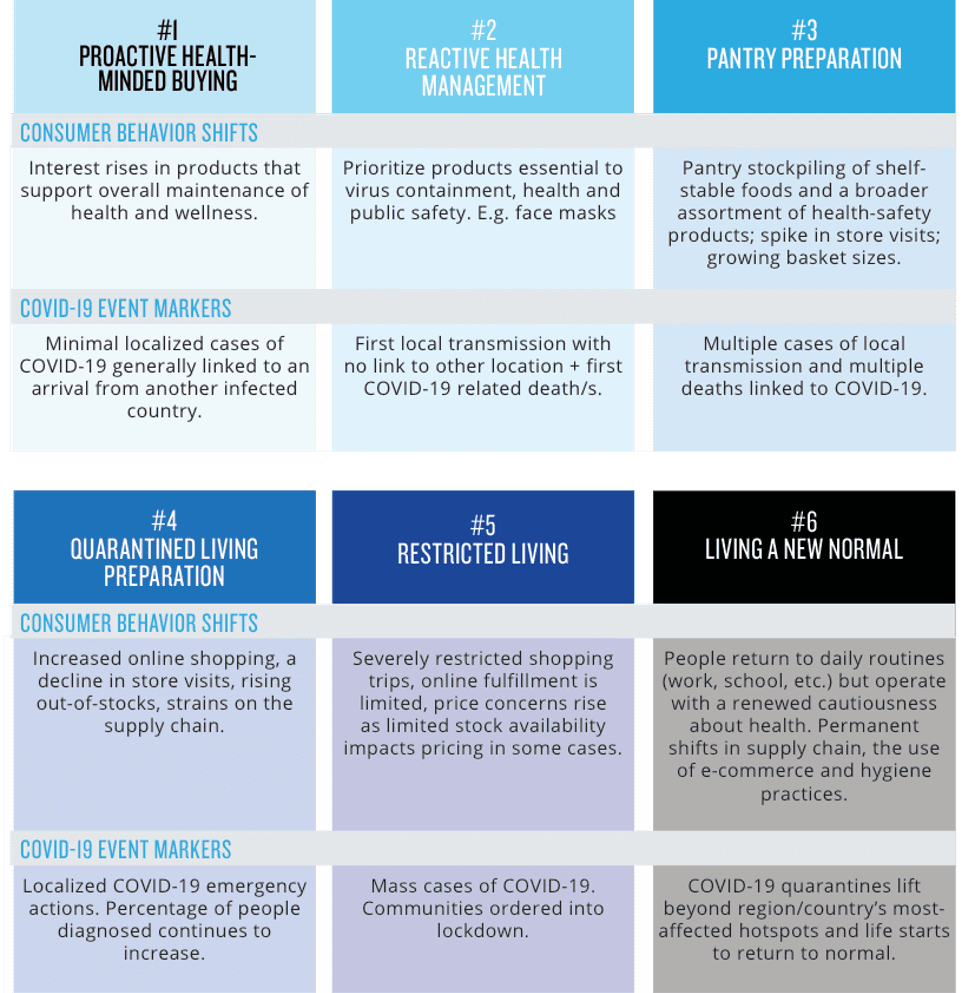

By the second month Nielsen has been analyzing shopper data from consumers in markets in Asia, Europe and North America, the company developed six “threshold levels” of consumer behavior in the COVID-19 era. These are 1-Proactive Health-Minded Buying, 2-Reactive Health Management, 3-Pantry Preparation, 4-Quantined Living Preparation, 5-Restricted Living, and 6-Living a New Normal.

There are implications for healthcare systems and plans across this continuum of consumer behavior. In the beginning, the consumer is interested in health-and-wellness bolstering products in general, an opportunity for the healthcare system to provide general health education on hygiene, the proper use of over-the-counter products, and symptomology of COVID-19. In the second phase of reactive health management, the consumer is seeking more medically-focused products, like face masks – which haven’t been shown to be efficacious. This round of patient engagement could target physician-oriented messaging germane to a call-to-action to get tested along with consumer education to help people avoid medical scams too-good-to-be-true.

In the third phase of pantry prep, consumers are looking at food-as-medicine and how to ensure family nutrition over time. Here, dietitians and nutritionists can play a role in education, collaboration with grocery chains for building immune-supporting shopping carts, and ensuring that people managing chronic conditions have access to healthy foods. Stage 4, preparing for quarantined living, sees supply chains strained, so providers taking risk must especially ensure a patient’s social determinants of health risks are being managed, with frequent check-ins from health coaches, nurses, diabetes educators, and community health workers in the field.

By the fifth phase, consumers are restricted in living situations, as we see in Italy this week as the nation is locked-down and all civic life on hold except for grocery stores and retail pharmacies. Here, the role of platform-ordering services like Xealth (a sort of “Surescripts for digital prescribing”), texting for medication reminders, and telehealth and virtual health would be useful. Finally, the sixth phase is “living a new normal,” where people adjust to returning to the usual lives – with the experience of living through the COVID-19 experience, bearing emotional, clinical, and financial scars.

The evolving coronavirus era in America will be worse before it gets much better, taking a page from Dr. Fauci, who helped shepherd the United States through the era when HIV/AIDS was a death sentence. He knows whereof he speaks. It will take our entire health/care village, truly an ecosystem in the original definition of the word, to collaborate through this public health challenge.

About The Author: Jane Sarasohn-Kahn, MA, MHSA

Through the lens of a health economist, Jane defines health broadly, working with organizations at the intersection of consumers, technology, health and healthcare. For over two decades, Jane has advised every industry that touches health including providers, payers, technology, pharmaceutical and life science, consumer goods, food, foundations and public sector.

More posts by Jane Sarasohn-Kahn, MA, MHSA